- Reverse Factoring

- Dynamic Discounting

- Reclaim cash tied up in your supply chain

- Reduce supply chain risk

- Strengthen supplier relationships

- Self-funded option

Your Business Case

- Delay cash outflows and improve your working capital position.

- Strengthen your negotiating position for better supplier terms.

- Improve investment returns – if you choose to self-fund a reverse factoring programme.

- Your suppliers benefit from improved cash-flow by getting early payment of their invoices. And, because their finance is based on your credit rating, they typically benefit from lower borrowing rates than are warranted by their own credit rating.

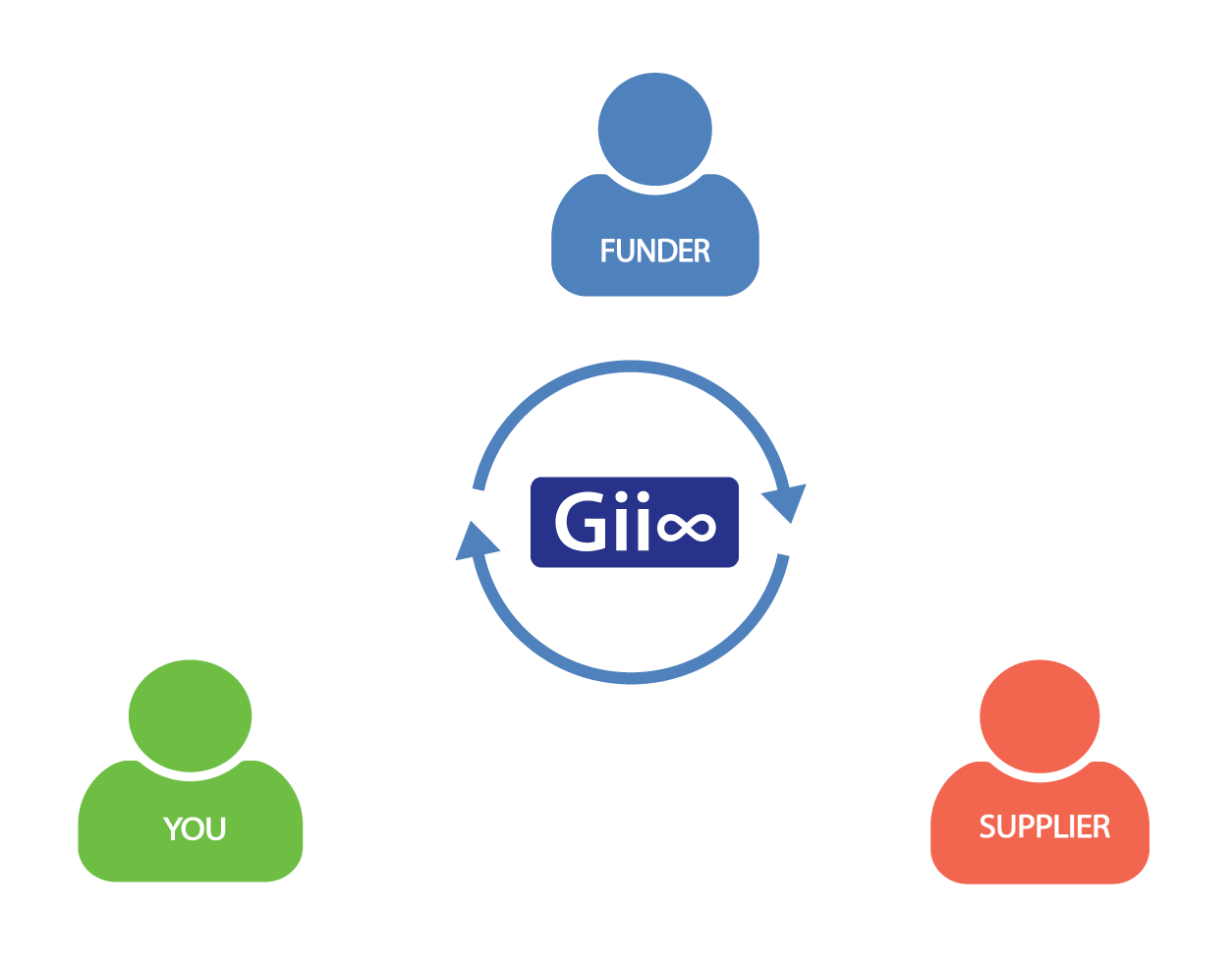

How it works

- You allow payment of your accounts payable to be funded (Funding Agreement).

- The funder pays your suppliers immediately, deducting a fee based on your credit rating and the days left until the invoice due date.

- You pay the funder when the invoices would normally be due or at a later date agreed with the funder.

Gii manages completion of the funding agreement, supplier on-boarding and all trading and settlement logistics based on your invoice data.

Financials

Benefits

Improved key financial liquidity and debt ratios:

- Improved cash-flow, through extended payment terms

- Lower working capital requirement

- Lower working capital financing costs

Costs

- You pay an annual network fee and a per supplier on-boarding fee.

- Your suppliers pay a one-off network fee, a transaction fee and the cost of finance agreed with the funder.

Supplementary fees are payable for optional services.

Will it work for you?

Reverse Factoring works well for businesses that have at least some of the following characteristics:

Senior position in business supply chain (strong buying power)

Strong credit rating

Large working capital requirement

Supply chain risks related to the financial stability of key suppliers

Significant cash on balance sheet (self-funded option)

Need more information?

Request a callback- Improve operating margins

- Reclaim cash tied up in your supply chain

- Reduce supply chain risk

- Self-funded option

Your Business Case

- Improve operating margins through reduced procurement spend.

- Delay cash outflows and improve your working capital position.

- Improve investment returns – if you choose to self-fund a dynamic discounting programme.

- Suppliers benefit from improved cash flow by getting early payment of their invoices.

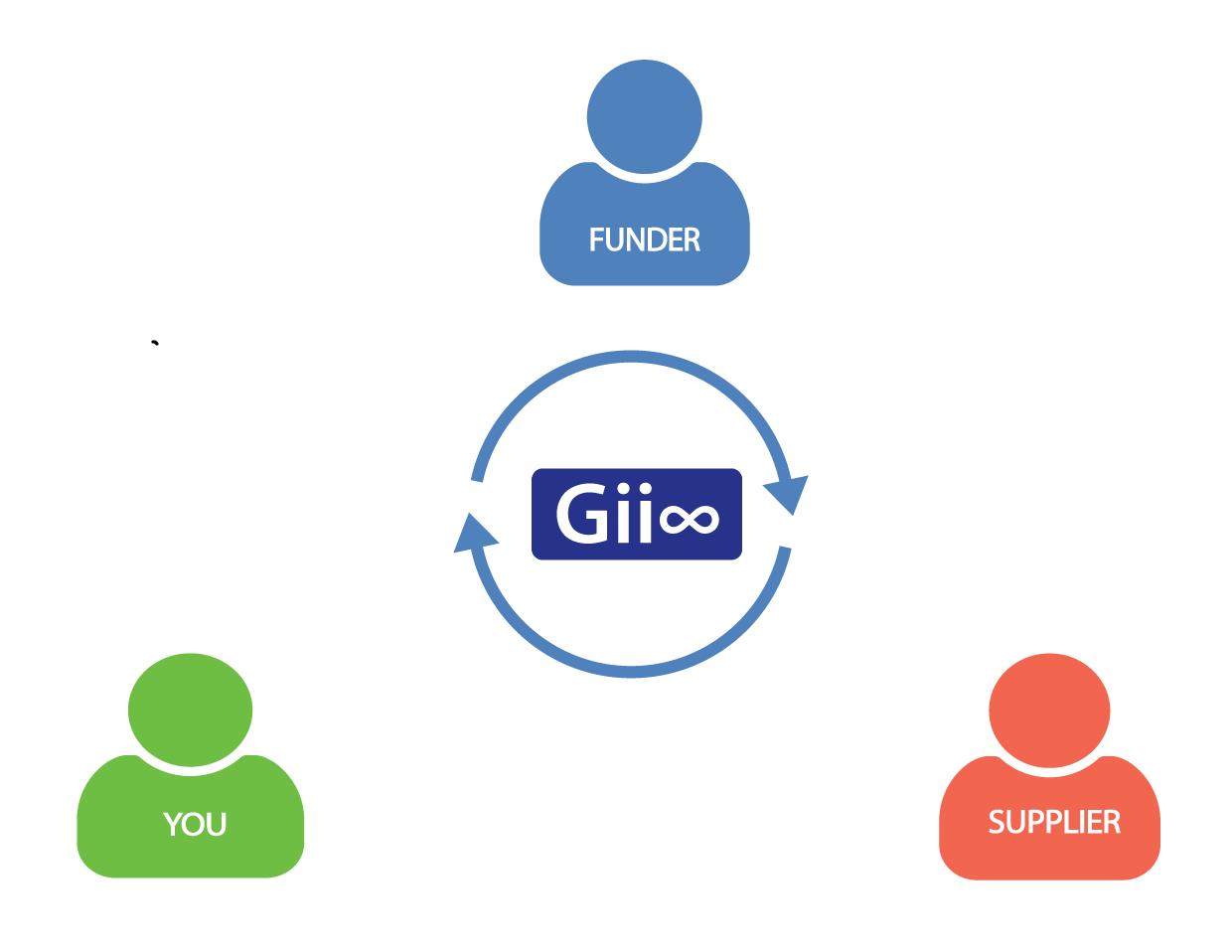

How it works

- You agree early payment discounts with your suppliers (Gii can help you with this).

- You allow payment of your supplier invoices to be funded (Funding Agreement).

- The funder pays your suppliers within the period you can claim a discount, deducting the amount of the discount from the amount paid.

- You pay the funder the discounted invoice amount, plus the financing fee agreed with the funder, when the invoices would normally be due or at a later date agreed with the funder.

Gii manages completion of the funding agreement, supplier on-boarding and all trading and settlement logistics based on your invoice data.

Financials

Benefits

Improved key financial liquidity, debt and profitability ratios:

- Reduced procurement spend

- Improved operating margins

- Improved cash flow

- Improved working capital (externally funded model)

- Lower working capital financing costs

Costs

- You pay an annual network fee and a transaction fee.

- For externally funded Dynamic Discounting programmes, you also pay a per supplier on-boarding fee and the cost of finance agreed with the funder.

Supplementary fees are payable for optional services.

Will it work for you?

Dynamic Discounting works well for businesses that have at least some of the following characteristics:

Senior position in business supply chain (strong buying power)

Strong credit rating

Large working capital requirement

Supply chain risks related to the financial stability of key suppliers

Significant cash on balance sheet (self-funded option)