- Invoice Discounting

- Invoice Factoring

- Accelerate cash conversion cycle

- Cost effective short-term finance

- No need to change existing business processes

Your Business Case

- Get substantial, immediate payment against your customer invoices, and benefit from improved cash flow and a reduced working capital requirement.

- Ring-fence the financial impact of customer late-payment.

- Funding does not tie up critical business assets - your funding is secured entirely on your customer receivables, with individual invoices creating a series of short-term obligations between you and the funder.

- Funding is directly linked to the value of your customer receivables - so you never pay costs for un-used financing.

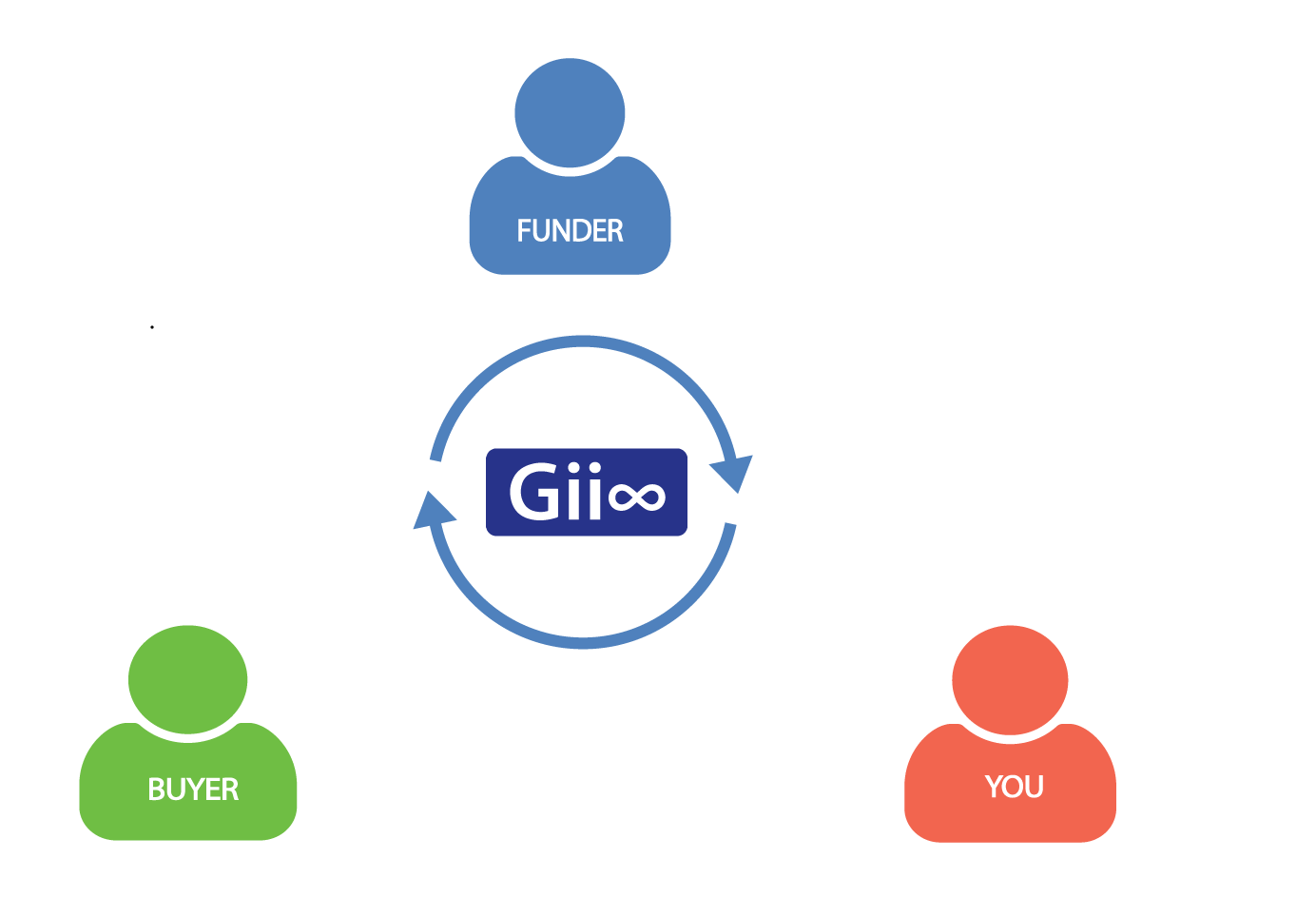

How it works

- You allow payment of your customer invoices to be funded (Funding Agreement).

- The funder immediately pays you a percentage of the value of your outstanding invoices (usually over 80%).

- You collect payment from your customers.

- You pay the funder the full amount collected.

- The funder pays you the balance due on your invoices, less a pre-agreed fee.

Gii arranges completion of the funding agreement, and manages all trading and settlement logistics based on your invoice data.

Financials

Benefits

Improved key financial liquidity and debt ratios:

- Improved cash-flow

- Lower working capital requirement

- Lower working capital financing costs

Costs

- You pay an annual network fee, a transaction fee and the cost of finance agreed with the funder.

Supplementary fees are payable for optional services.

Will it work for you?

Invoice discounting works well for businesses that have at least some of the following characteristics:

Rapid business growth

Significant invoice value with a small number of corporate customers

Long customer payment terms

Large working capital requirement

Need more information?

Request a callback- Accelerate cash conversion cycle

- Cost effective short-term finance

- Secure your income

- Reduce investment in invoice collection

Your Business Case

- Get substantial, immediate payment against your customer invoices, and benefit from improved cash flow and a reduced working capital requirement.

- Secure your income – the funder assumes the risk of customer non-payment through non-recourse financing.

- Reduce or even eliminate investment in Accounts Receivable processes and software.

- Funding is directly linked to the value of your customer receivables - so you never pay for un-used finance.

- Funding does not tie up critical business assets - your funding is secured entirely on your customer receivables - with individual invoices creating a series of short-term obligations between you and the funder.

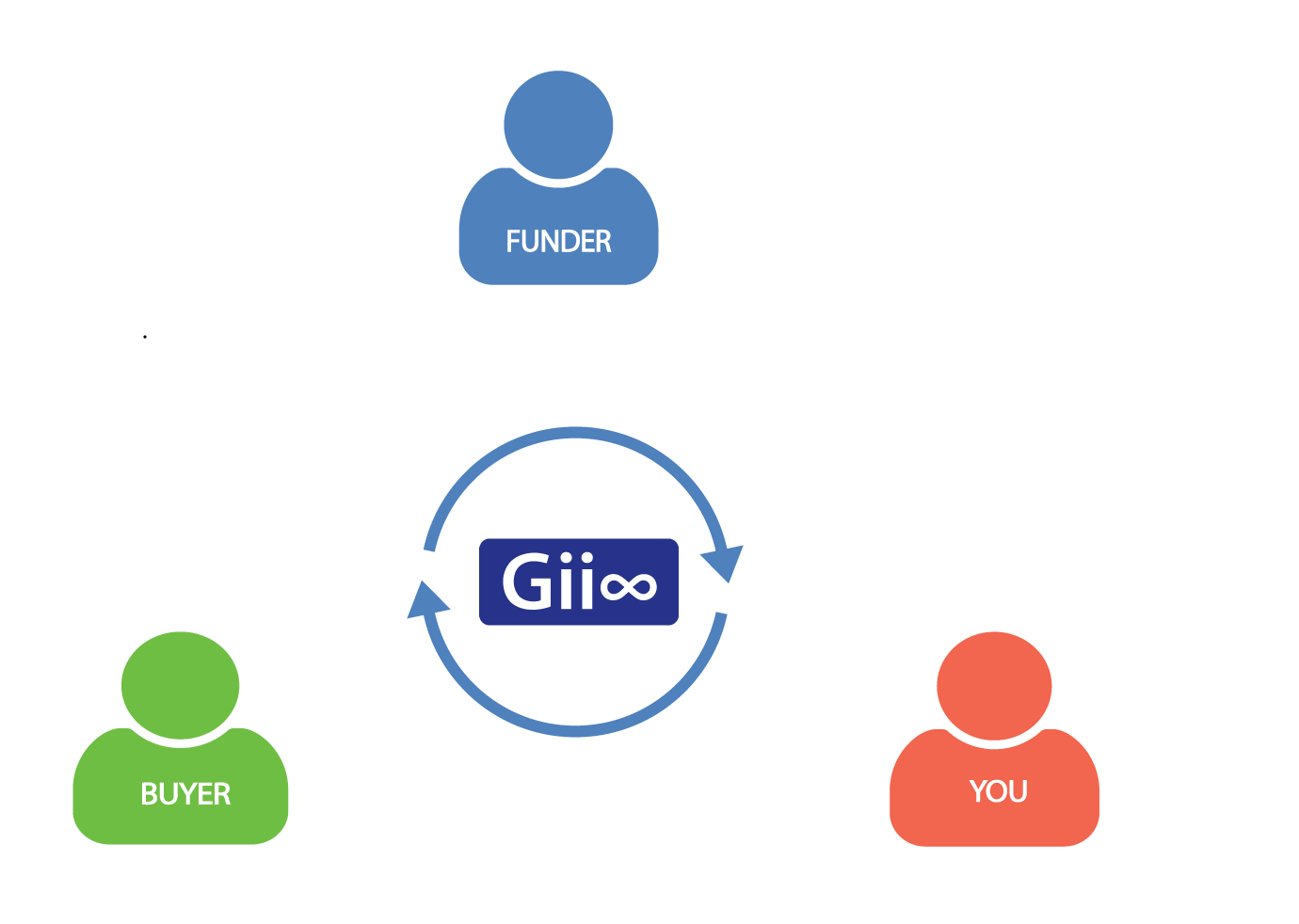

How it works

- You allow payment of your customer invoices to be funded (Funding Agreement).

- The funder immediately pays you a percentage of the value of your outstanding invoices (usually over 80%).

- Gii arranges for the collection of payment from your customers.

- Gii pays the funder the full amount collected.

- The funder pays you the balance due on your invoices, less a pre-agreed fee.

Gii arranges completion of the funding agreement, and manages all trading and settlement logistics based on your invoice data.

Financials

Benefits

Improved key financial liquidity and debt ratios:

- Improved cash-flow

- Lower working capital requirement

- Lower working capital financing costs

- Reduced credit management costs

Costs

- You pay an annual network fee, a transaction fee and the cost of finance agreed with the funder.

- You also pay a management fee for credit management activities.

Supplementary fees are payable for optional services.

Will it work for you?

Invoice Factoring works well for businesses that have at least some of the following characteristics:

Rapid business growth

Significant invoice value with a small number of corporate customers

Long customer payment terms

Preference not to invest further in invoice collection activities

Large working capital requirement